The Future of Real Estate Sector in Canada

Introduction

The Canadian real estate market has long been a cornerstone of the nation’s economy. It serves not only as a barometer of financial health but also as a critical driver of wealth creation for many Canadians. With its vast landscapes and diverse urban centers, the real estate sector in Canada offers a fascinating blend of opportunities and challenges. As we look towards the future, understanding the dynamics at play becomes crucial for stakeholders at all levels.

Historical Context

The evolution of the real estate market in Canada has been marked by significant milestones. From the post-war housing boom of the 1950s to the urban sprawl of the late 20th century, each era has shaped the market in unique ways. Major shifts, such as the introduction of condominium laws and the liberalization of mortgage regulations, have further influenced the landscape, making real estate a pivotal sector in the country’s economic narrative.

Current State of the Market

Today, the Canadian real estate market is characterized by robust activity and dynamic trends. Major cities like Toronto and Vancouver continue to experience high demand, while smaller markets are seeing increased interest due to remote work trends. Key players, including developers, investors, and policymakers, play crucial roles in shaping the market’s trajectory, each bringing their own perspectives and strategies.

Economic Influences

Global economic trends exert a profound influence on Canada’s real estate sector. Economic downturns, trade policies, and foreign investment flows are just a few of the factors that can sway market conditions. Domestically, economic policies such as interest rate adjustments and fiscal stimulus measures directly impact housing affordability and investment viability.

Technological Advancements

Technological innovation is revolutionizing the real estate industry. PropTech, or property technology, is transforming how properties are bought, sold, and managed. Smart home technologies are increasingly becoming standard, enhancing security, convenience, and energy efficiency. These advancements not only streamline processes but also add significant value to properties.

Urbanization Trends

Urbanization continues to shape Canada’s real estate landscape. The growth of major cities is driving demand for housing and commercial spaces, creating both opportunities and challenges. As urban areas expand, issues such as congestion, infrastructure strain, and housing affordability become more pronounced, necessitating innovative urban planning solutions.

Demographic Shifts

Canada’s demographic landscape is evolving, with significant implications for real estate. An aging population is leading to increased demand for senior housing and accessible homes. Simultaneously, migration patterns, driven by both international immigration and internal relocation, are influencing housing demand in various regions, creating a dynamic and ever-changing market environment.

Environmental Considerations

Sustainability is becoming a central concern in real estate development. Government regulations are increasingly mandating environmentally friendly building practices, and there is a growing market for green buildings. Sustainable construction not only helps mitigate environmental impact but also meets the rising consumer demand for eco-friendly living options.

Financial Aspects

The financial landscape of real estate in Canada is complex and multifaceted. Mortgage rates, a critical factor for homebuyers, are influenced by a range of economic indicators and central bank policies. Investment trends are also shifting, with a growing interest in real estate investment trusts (REITs) and other investment vehicles that offer exposure to the property market without the need for direct ownership.

Government Policies

Government policies play a pivotal role in shaping the real estate market. Housing policies, including those aimed at increasing affordability and supply, have significant impacts. Taxation policies and incentives can either stimulate or stifle market activity, making it essential for stakeholders to stay abreast of policy changes and their potential implications.

Market Challenges

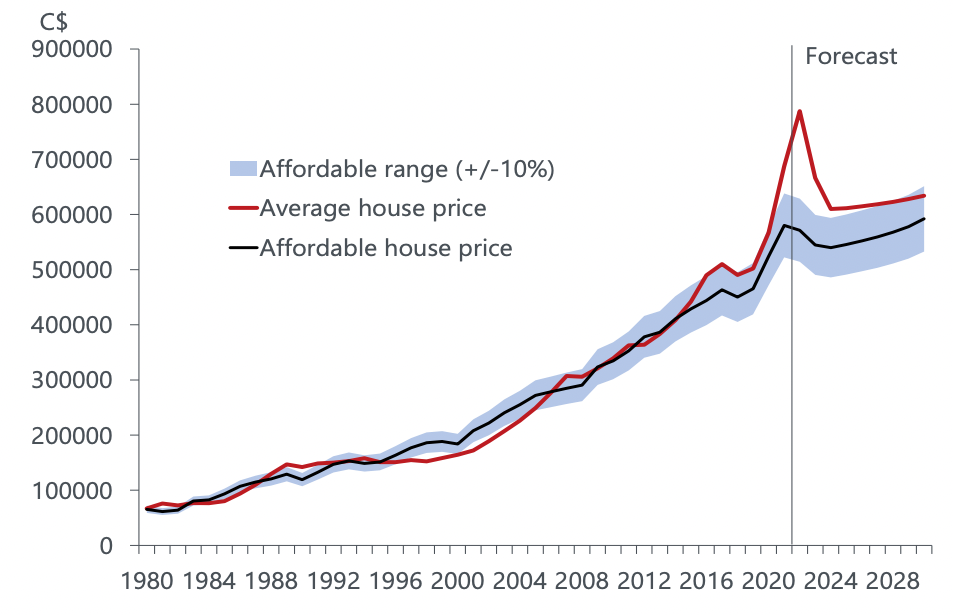

The Canadian real estate market faces several challenges, foremost among them being affordability issues. Rising prices have made homeownership increasingly difficult for many Canadians, particularly in major cities. Housing supply constraints further exacerbate this issue, with demand outstripping supply in many areas, leading to competitive bidding and higher prices.

Future Prospects

Looking ahead, certain areas are predicted to experience significant growth. Emerging markets, often overlooked, are beginning to attract attention due to their potential for high returns. These markets, typically characterized by lower entry costs and higher growth potential, offer lucrative opportunities for investors willing to venture beyond established urban centers.

Role of Foreign Investment

Foreign investment has long been a controversial topic in Canadian real estate. International buyers have been drawn to the stability and profitability of the market, particularly in major cities. However, this influx of foreign capital has also prompted concerns about affordability and housing availability for local residents, leading to government measures aimed at regulating foreign investments.

Technological Disruptions

The future of real estate will be heavily influenced by technological disruptions. Artificial intelligence (AI) and big data are poised to revolutionize property management, investment analysis, and customer service. Virtual reality (VR) is transforming the way properties are marketed and viewed, offering immersive experiences that can significantly enhance the buying process.

Shifts in Consumer Preferences

Consumer preferences in real estate are evolving. Homebuyers are increasingly prioritizing features such as energy efficiency, smart home capabilities, and proximity to amenities. The rise of remote work is also influencing preferences, with many buyers seeking homes that offer suitable workspaces and a better work-life balance.

Real Estate Development Trends

Development trends in Canadian real estate are shifting towards mixed-use developments and sustainable buildings. Mixed-use projects, which combine residential, commercial, and recreational spaces, are becoming more popular as they offer convenience and community integration. Sustainable buildings, designed with environmental impact in mind, are also on the rise, reflecting a broader trend towards eco-friendly living.

Commercial Real Estate Outlook

The outlook for commercial real estate in Canada is varied. Office spaces are undergoing a transformation due to remote work trends, with flexible and co-working spaces becoming more prevalent. Retail real estate faces challenges from the rise of e-commerce, while industrial real estate is experiencing growth driven by logistics and warehousing needs.

Impact of Climate Change

Climate change poses significant risks to real estate, particularly in areas vulnerable to extreme weather events. Properties in coastal and flood-prone areas are at increased risk, prompting the need for adaptation and resilience strategies. Developers and investors are increasingly considering climate risks in their planning and investment decisions.

Regional Analysis

Real estate market conditions vary significantly across Canada’s provinces. Major provinces such as Ontario, British Columbia, and Alberta each have unique market dynamics driven by economic conditions, population growth, and government policies. Understanding these regional differences is crucial for making informed investment and development decisions.

Conclusion

In conclusion, the future of the real estate sector in Canada is shaped by a myriad of factors, from economic trends and technological advancements to demographic shifts and environmental considerations. By staying informed and adaptable, stakeholders can navigate the complexities of the market and capitalize on emerging opportunities. The Canadian real estate market remains a dynamic and vital component of the nation’s economy, poised for continued evolution and growth.