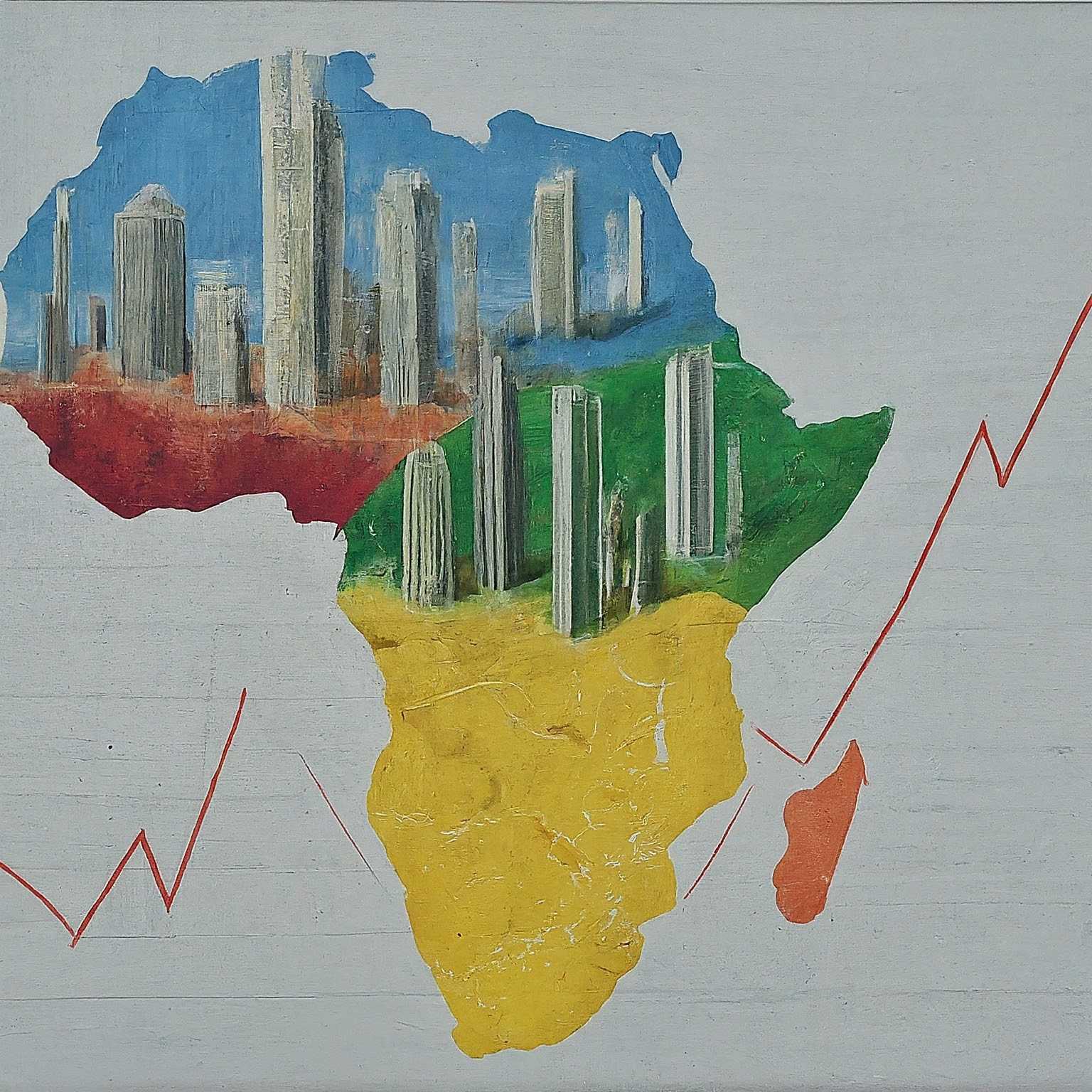

Africa’s real estate sector is on the cusp of a transformative era, characterized by rapid urbanization, robust economic growth, and significant demographic shifts. This analysis delves into the key factors driving the sector’s growth, providing detailed insights, historical context, and future projections. We focus on some of the most promising countries for real estate investment, highlighting opportunities, challenges, and critical data points for professional research.

Key Drivers of Real Estate Growth in Africa

- Urbanization Trends:

- Africa’s urban population is expected to double over the next three decades, increasing from approximately 600 million in 2020 to 1.2 billion by 2050. This unprecedented urban growth will drive substantial demand for residential, commercial, and infrastructure development.

- Major cities like Lagos, Nairobi, Johannesburg, and Kigali are expanding rapidly, necessitating significant investments in housing, office spaces, retail centers, and urban infrastructure.

- Population Growth:

- The continent’s population is projected to reach 2.5 billion by 2050, up from about 1.3 billion in 2020. This population boom will predominantly be in urban areas, further intensifying the need for comprehensive real estate development.

- Youthful demographics mean a larger workforce and increased economic activity, which will bolster demand for both residential and commercial properties.

- Economic Development:

- Several African economies are experiencing robust growth. For instance, Ethiopia, Kenya, and Rwanda have consistently recorded GDP growth rates of 5-10% annually, fostering a conducive environment for real estate investments.

- Diversification efforts in economies like Nigeria and South Africa are opening up new sectors, including technology, manufacturing, and services, which require modern real estate solutions.

- Infrastructure Investments:

- Governments and international investors are pouring resources into improving infrastructure, such as transportation networks, utilities, and communication systems. Enhanced infrastructure supports real estate development by making areas more accessible and livable.

- Notable projects include Kenya’s Konza Technopolis, Nigeria’s Eko Atlantic City, and Rwanda’s Kigali Special Economic Zone, all of which are set to significantly impact the real estate landscape.

- Foreign Investment:

- There is growing interest from global investors, particularly from China, the Middle East, and Europe. These investments bring not only capital but also expertise and best practices, accelerating the development of high-quality real estate projects.

- Public-private partnerships (PPPs) are becoming more common, facilitating large-scale developments that might be challenging for local investors to undertake alone.

Analysis of Key Countries for Real Estate Investment

1. South Africa

- Economic Stability and Market Maturity:

- South Africa boasts a relatively mature and sophisticated real estate market with well-developed financial systems and transparent regulatory frameworks.

- Key cities such as Johannesburg, Cape Town, and Durban offer diverse investment opportunities across residential, commercial, and industrial segments.

- Data: Johannesburg’s prime office rents average $20 per square meter per month, and Cape Town’s residential property prices have increased by an average of 8% annually over the past five years.

- Challenges: The market faces economic volatility and political instability, which can pose risks to investors.

2. Kenya

- Rapid Economic Growth and Innovation:

- Kenya is one of Africa’s fastest-growing economies, driven by a strong focus on technology and innovation, particularly in Nairobi, the “Silicon Savannah.”

- Real estate opportunities abound in residential housing, office spaces, and retail developments, supported by a growing middle class and increased foreign investment.

- Data: Nairobi’s real estate market has seen a 10% annual growth in property prices. The Konza Technopolis project is a flagship initiative that is expected to boost real estate development significantly.

- Challenges: Investors face regulatory complexities and land ownership issues that require careful navigation.

3. Nigeria

- High Demand Driven by Population Growth:

- Nigeria, Africa’s most populous country, presents vast real estate opportunities, particularly in rapidly urbanizing cities like Lagos and Abuja.

- The country’s youthful population and urban migration drive demand for housing, commercial spaces, and mixed-use developments.

- Data: Lagos’s property market offers potential annual returns on investment (ROI) of 15-20%. Abuja’s luxury real estate market is expanding, with high demand for upscale housing.

- Challenges: Political instability, economic fluctuations, and infrastructure deficits are significant hurdles for investors.

4. Rwanda

- Political Stability and Strategic Vision:

- Rwanda is renowned for its stable political environment and strong governance, making it one of the safest and most attractive investment destinations in Africa.

- Kigali, the capital, is experiencing steady growth in the real estate sector, driven by government initiatives and foreign investment.

- Data: Kigali’s real estate market has grown by 8% annually. The Kigali Special Economic Zone is attracting significant real estate development.

- Challenges: The market size is limited compared to larger African economies, which may restrict the scale of investments.

Growth Charts and Projections

Population Growth Projections

To visualize the demographic trends, the following chart projects population growth in key African countries from 2020 to 2050:

Real Estate Market Growth Projections

This chart illustrates the projected compound annual growth rates (CAGR) for real estate markets in key African countries from 2020 to 2050:

Conclusion

The future of real estate in Africa is bright, with substantial growth potential driven by urbanization, population expansion, and economic development. South Africa, Kenya, Nigeria, and Rwanda are among the most promising countries for real estate investment, each offering unique opportunities and challenges. For professional researchers and investors, understanding these dynamics and leveraging the detailed data and projections provided can lead to informed and strategic investment decisions, contributing to the continent’s economic development and urban transformation.